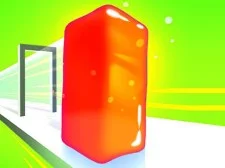

I can Paint

Super healing casual graffiti game. All you have to do is push the paint bucket around and make it move, and it will start to create a nice picture of the stars. Right? Or develop your imagination and create whatever you want to draw!

Super healing casual graffiti game. All you have to do is push the paint bucket around and make it move, and it will start to create a nice picture of the stars. Right? Or develop your imagination and create whatever you want to draw!

Categories and tags of the game : 3d, Arcade, Kid, Kids, Kidsgame, Puzzle